Personal Finance 101: Universal Guide for Everyone

Managing money effectively is one of the most valuable life skills—yet many people never receive formal training in it. Whether you’re saving for a home, paying off debt, or building long-term wealth, understanding personal finance gives you the foundation to make smarter financial decisions. In today’s interconnected world, financial planning global and money management worldwide principles apply universally, regardless of currency or culture.

This comprehensive guide breaks down the essentials of personal finance, offering timeless strategies that help people everywhere take control of their economic future.

Understanding Personal Finance

Personal finance refers to managing your own money to meet current and future needs. It includes budgeting, saving, investing, and protecting your assets through insurance and planning.

In essence, it’s how you handle your income, expenses, and goals to ensure financial stability and independence.

The core pillars of personal finance are:

- Income – all the money you earn or receive

- Expenses – the money you spend, from necessities to luxury items

- Savings and Investments – your funds for future growth and goals

- Protection – your insurance and safety nets against risks

- Planning – your strategies for long-term financial goals

Why Personal Finance Matters Globally

Around the world, people’s financial systems may differ, but their challenges are surprisingly similar. Whether in London, Lagos, or Los Angeles, everyone faces decisions about debt, income, and long-term planning. That’s why money management worldwide follows universal principles.

Good personal finance practices:

- Reduce stress by providing control over money.

- Improve quality of life through better resource allocation.

- Prepare you for emergencies or unexpected changes.

- Enable you to achieve both short-term desires and lifetime goals.

The Foundations of Financial Success

Building a strong personal finance base starts with understanding your current situation and setting achievable goals. Let’s explore the step-by-step path toward sustainable financial well-being.

1. Know Where You Stand

Before taking action, analyze your financial situation. Create a clear picture by listing:

- Total income (salary, bonuses, passive income)

- Fixed expenses (rent, utilities, insurance)

- Variable expenses (food, entertainment)

- Total debts and assets

This step helps you identify your net worth, which is simply your total assets minus your total liabilities. Tracking this regularly will show your financial progress over time.

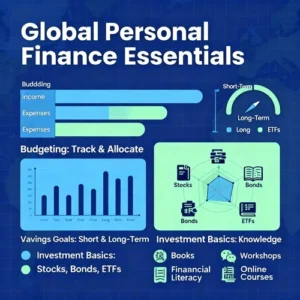

2. Create a Realistic Budget

A budget is the backbone of money management worldwide. The goal is not to restrict spending but to consciously allocate your money.

A powerful rule is the 50/30/20 method:

- 50% of income for needs

- 30% for wants

- 20% for savings or debt repayment

Digital tools like Mint, YNAB, or Excel spreadsheets can help automate and visualize your progress. Adjust your budget monthly as your circumstances evolve.

3. Save Before You Spend

When it comes to saving, the golden rule is “pay yourself first.” Automate a percentage of your income into savings or investments before you spend on lifestyle choices.

Types of savings goals:

- Emergency fund: Aim for 3–6 months of living expenses to cover unexpected events.

- Short-term goals: Vacations, car purchases, or new gadgets.

- Long-term goals: Retirement, home ownership, or children’s education.

Global financial planning studies show people with designated savings goals are up to 70% more likely to achieve them.

4. Manage Debt Wisely

Debt can be either a tool for growth or a trap that drains your finances. Effective debt management is essential for overall personal finance health.

Steps to control debt:

- List all debts (loans, credit cards, mortgages) with interest rates.

- Prioritize high-interest debts (over 15%) first—this frees your money faster.

- Consider the debt snowball or debt avalanche method for paying off systematically.

- Avoid new unnecessary borrowing until existing debts are under control.

Globally, minimizing high-interest debt is a cornerstone of financial planning across all cultures.

5. Build an Investment Strategy

Saving alone will not build wealth due to inflation. Investing channels your money into assets that work for you over time.

Fundamental investment options:

- Stocks and mutual funds: High potential growth, suitable for long-term goals.

- Bonds: Lower-risk instruments that provide stability.

- Real estate: Tangible assets that can yield rental income or appreciation.

- Index funds and ETFs: Provide diversification at low cost.

- Global investments: Diversify geographically through international funds or markets.

Always consider your risk tolerance, time horizon, and financial goals before investing. Seek professional advice or global financial planning guidance when investing across borders.

6. Secure Your Future with Insurance

Insurance protects your wealth from life’s uncertainties. Proper coverage ensures that your progress remains intact even during crises.

Key types of insurance:

- Health insurance – covers medical expenses.

- Life insurance – protects dependents in case of death.

- Property insurance – covers home or vehicle losses.

- Disability insurance – supports income during illness or injury.

Choosing the right mix of insurance aligns with global financial planning practices, offering peace of mind regardless of where you live.

7. Plan Your Retirement Early

The earlier you start, the better your retirement will be. Compounding returns reward time and consistency.

Tips for effective retirement planning:

- Contribute regularly to retirement accounts (401(k), IRA, pension plans).

- Take advantage of employer matching programs.

- Diversify across safe and growth-oriented investments.

- Estimate future living costs and adjust your plan accordingly.

Around the world, the principle remains the same—retirement planning is essential to secure financial freedom later in life.

8. Build Financial Literacy Continuously

Money habits evolve with changing economies and technologies. Committing to lifelong learning ensures you adapt effectively.

Practical ways to improve financial knowledge:

- Read reputable finance blogs and books.

- Follow certified financial planners and economists.

- Learn global money trends—digital banking, cryptocurrencies, ESG investing.

- Take free or online financial literacy courses.

Personal finance education fosters better decision-making and empowers individuals across all cultures.

9. Diversify Income Streams

In uncertain times, relying solely on a primary job can be risky. Diversification ensures stability even during economic downturns.

Potential income streams:

- Freelancing or consulting

- Dividend or interest income

- Real estate rental revenue

- Online side businesses

- Licensing or passive content revenue

Embracing global digital opportunities has made money management worldwide more accessible than ever.

10. Think Long-Term: Build Wealth, Not Just Income

True financial freedom does not come from earning more; it comes from keeping and growing what you earn. That requires discipline, vision, and patience.

Core wealth-building habits:

- Regular saving and investing

- Controlling lifestyle inflation

- Reviewing your financial goals annually

- Reinvesting profits from side ventures

- Maintaining an emergency and opportunity fund

Whether in developing or advanced economies, these personal finance principles remain universal.

Global Financial Planning in a Changing World

Financial planning global is adapting to new realities—digital currencies, automation, and borderless markets. Individuals must stay proactive, adopting new tools and perspectives that align with modern economies.

Emerging financial trends include:

- FinTech platforms revolutionizing investment access.

- AI-powered budgeting and wealth management apps.

- Sustainable and ethical investment opportunities expanding worldwide.

- Global tax and residency planning for remote workers.

Understanding and leveraging these tools helps individuals thrive financially, no matter where they live or work.

The Human Side of Personal Finance

Numbers alone don’t drive success—mindset and behavior play a major role. Global research shows people who link financial habits to personal values maintain discipline longer.

Adopt a purpose-driven financial plan by:

- Defining what financial success means to you personally.

- Aligning spending habits with your values.

- Practicing gratitude and generosity—two mindsets strongly correlated with long-term wealth satisfaction.

Ultimately, personal finance is as emotional as it is mathematical.

Common Global Mistakes in Money Management

Avoid these pitfalls that often derail financial progress:

- Ignoring hidden fees and inflation when saving.

- Depending solely on one income source.

- Failing to invest due to fear of risk.

- Overspending on lifestyle rather than essentials.

- Not reviewing finances regularly.

Awareness of these behaviors helps create more sustainable financial habits.

Conclusion: Financial Freedom Is a Universal Journey

Personal finance is not just about money—it’s about freedom, security, and purpose. Across cultures and continents, the path to financial independence shares the same foundation: consistency, clarity, and courage.

No matter where you live or what you earn, the principles of financial planning global and money management worldwide can empower you to take control of your future. By following these proven steps—budgeting, saving, investing, protecting, and learning—you lay the groundwork for lasting prosperity.

Start today. The best time to take charge of your financial destiny is always now.